Net Revenue Retention is a metric that determines the percentage of a company's recurring income that is retained from one period to the next. It is measured by subtracting the amount of churned revenue from the current period's revenue, and then dividing this number by the prior period's revenue. This metric reflects a firm's capability to retain its existing customer base and generate steady income.

It's important to note that Net Revenue Retention does not include one-time or non-recurring revenue.

For example, if your SaaS company earned $50,000 in recurring revenue from existing customers in 2020, compared to $40,000 in 2019, then your net revenue retention rate would be 125%.

This means that you have increased your recurring revenue by 25% year-over-year.

Net Revenue Retention is an important metric because it helps SaaS companies track customer loyalty and churn rate.

It also helps them understand how successful their marketing, sales, and success efforts are at retaining customers and growing their business over time.

A higher NRR indicates that a company is successfully engaging its existing customer base and attracting new customers as well.

Net Revenue Retention can also be used as a benchmark for comparing different SaaS companies and assessing their performance over time. Companies with higher net retention rates tend to have better customer service and more reliable products than those with lower rates.

This makes Net Revenue Retention an invaluable tool for SaaS companies looking to stay ahead of the competition.

Net Revenue Retention is an important metric for any SaaS company looking to increase its customer base and maximize its profits over time. By tracking this metric regularly, businesses can gain valuable insights into their customer loyalty levels and overall performance in the market.

The formula for calculating net revenue retention is:

Net Revenue Retention = (Revenue in Current Period - Churned Revenue) / Revenue in Previous Period

Where:

It’s also important to consider any one-time charges or discounts when calculating Net Revenue Retention.

If a customer has received a discount or been charged a one-time fee, this should be excluded from the calculation as it does not reflect the customer’s spending habits over time.

Net Revenue Retention can provide valuable insight into the health of your business by helping you understand how well you are retaining customers and generating recurring revenue over time.

It can also help you identify areas where improvement may be needed so that you can focus your efforts on increasing customer retention rates and boosting long-term profitability.

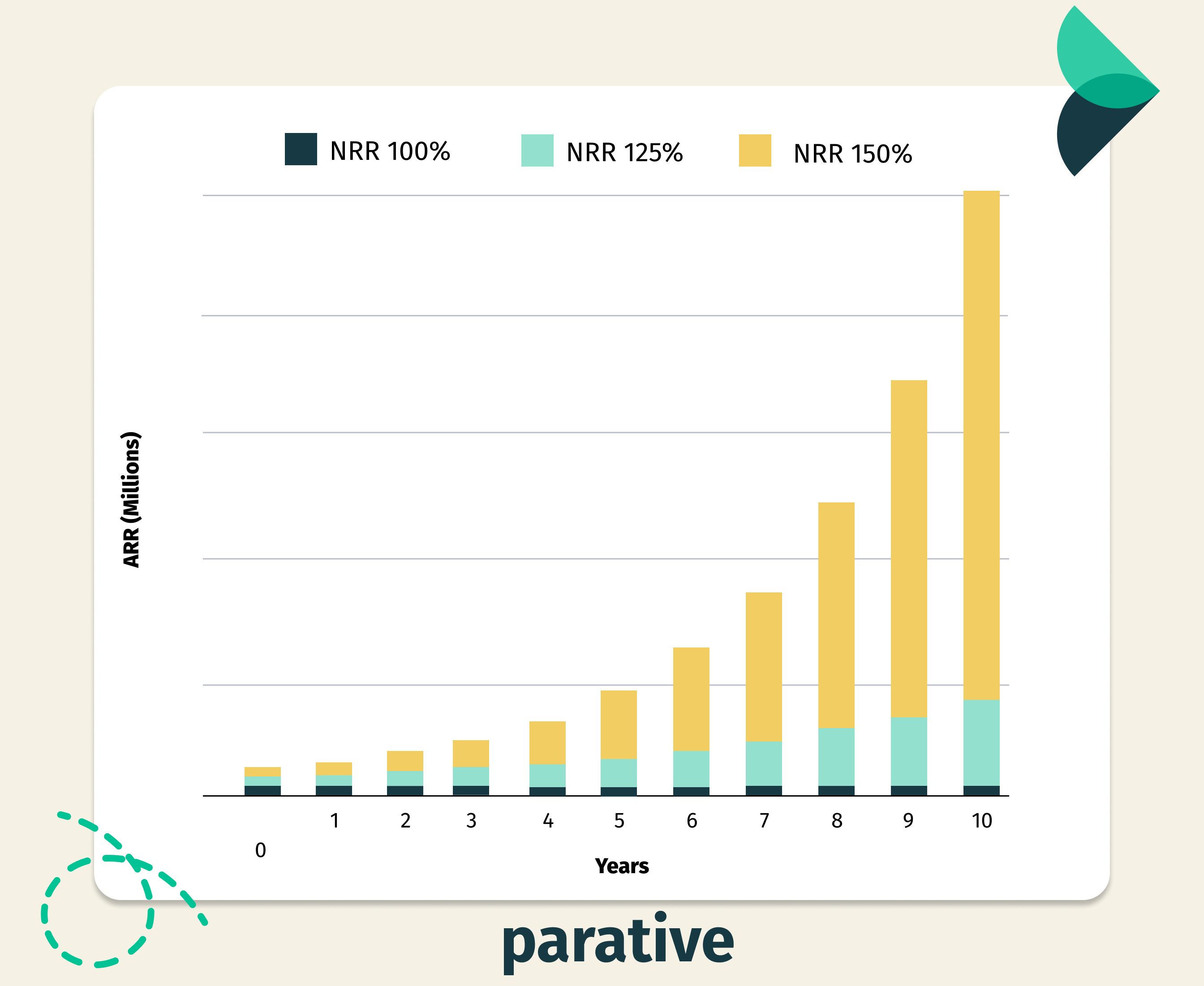

Generally speaking, an NRR rate above 100% indicates that the company has grown its revenue from existing customers. Anything below 100% means that revenue has decreased or remained stagnant. An NRR rate above 120% indicates particularly strong growth and should be considered excellent performance.

However, for smaller SaaS companies, the expectations related to NRR are lower.

For SMBs, a Net Revenue Retention Rate of over 90% is considered good and indicates that a company is successfully retaining its customers and growing its revenue.

An NRR below 90% may indicate that the company is struggling to retain customers and grow revenue and may need to re-evaluate its pricing strategy or customer experience.

It's important to note that Net Revenue Retention is just one metric among many that can be used to measure the health and growth of a SaaS company and should be evaluated in the context of other financial and operational metrics.

Additionally, a high NRR is not always sustainable, and companies should continually evaluate their pricing and customer experience strategies to ensure long-term growth.

For the purposes of SaaS metrics to track, Net Revenue Retention (NRR) and Net Dollar Retention (NDR) are, in essence, interchangeable.

However, if we were to be sticklers about definitions, we could say that they are technically different.

Net Revenue Retention and Net Dollar Retention are similar metrics, but they track different information. Net Revenue Retention measures the proportion of a firm's recurring revenue that persists from period to period, calculated by subtracting churned revenue from the current period's income and then dividing by the prior period's earnings. Whereas, Net Dollar Retention measures the dollar value kept from one interval to another; determined by taking away the total amount of churned revenue from the present period's income.

For example, if a company A generates $100,000 in revenue in a given month and $90,000 in the same month the previous year, its net revenue retention would be 100,000/90,000 = 111%. Net Dollar Retention is a measure of the revenue a company can retain from its existing customer base over a given period. It is calculated by comparing a company's revenue from its existing customers in a given period to the revenue it generated from those same customers in the same period the previous year.

For example, if company B generates $50,000 in revenue from its existing customers in a given month and $40,000 in the same month the previous year, its net dollar retention would be 50,000/40,000 = 125%. Both net revenue retention and net dollar retention are important metrics for a company to track, as they can help indicate the health of the business and its ability to retain and grow its customer base.

To sum up, Net Revenue Retention keeps tabs on the percentage of continuing revenue that remains, whereas Net Dollar Retention records the dollar worth of income retained.

Gross revenue retention refers to the amount of revenue that a company retains from its existing customers without factoring in any new revenue from either existing or new customers. It takes into account only the revenue generated from the customers who have been with the company in the previous period.

On the other hand, net revenue retention takes into account the revenue generated from existing customers, but it also considers any new revenue generated from upselling, cross-selling, or expansion revenue from existing customers. It subtracts any lost revenue from the previous period, such as customers who have churned or canceled their contracts.

Therefore, the key difference between gross revenue retention and net revenue retention is that net revenue retention considers new revenue generated from existing customers, while gross revenue retention does not.

Net Revenue Retention (NRR) is an essential metric for SaaS (Software as a Service) companies, as it provides valuable insight into the health and growth of the business. By regularly monitoring NRR, SaaS companies can evaluate their performance and make informed decisions about pricing, customer experience, and product development.

A low NRR rate can indicate several issues that need to be addressed. For example, if a SaaS company has a low NRR rate, it may indicate that the company needs to improve its customer experience. This can be achieved by providing better customer support, addressing customer pain points, and delivering high-quality products and services. The company may also need to re-evaluate its pricing strategy, as a pricing model that is too high or too low may be causing customers to churn. Additionally, the company may need to develop new products or features that better meet the needs of its customers.

On the other hand, if a SaaS company has a high NRR rate, it may indicate that the company is effectively retaining its customers and growing its revenue. In this case, the company may consider expanding its product offerings or increasing its prices to capitalize on its success. The company may also consider investing in customer success programs, which focus on proactively helping customers achieve their desired outcomes and maximizing their value from the company's products and services.

In conclusion, monitoring NRR is essential for SaaS companies, as it provides valuable insight into the health and growth of the business. By regularly monitoring NRR, SaaS companies can evaluate their performance, identify areas for improvement, and make informed decisions about pricing, customer experience, and product development.

Churn can have a significant impact on a company's Net Revenue Retention (NRR) rate, as losing customers can reduce the overall revenue generated from the existing customer base.

NRR measures the increase or decrease in revenue generated from a company's existing customer base after taking into account the impact of changes in pricing and the addition or removal of customers. If a SaaS company experiences high levels of churn, it may result in a decrease in the overall revenue generated from the existing customer base. - i.e., revenue churn - leading to a lower NRR rate.

On the other hand, if a SaaS company is able to effectively reduce churn and retain its customers, it can lead to an increase in the overall revenue generated from the existing customer base and a higher NRR rate. This highlights the importance of reducing churn for SaaS companies and the impact that churn can have on NRR.

In conclusion, churn is a critical metric for SaaS companies and can have a significant impact on NRR. Reducing churn and retaining customers can lead to an increase in the overall revenue generated from the existing customer base and a higher NRR rate, while high levels of churn can result in a decrease in revenue and a lower NRR rate. SaaS companies should regularly monitor their churn rates and take steps to reduce churn to ensure a healthy NRR rate and sustained growth.

There are several strategies organizations can use to improve their NRR, including investing in customer success, identifying and addressing potential issues, offering additional value, utilizing automation and AI, and more.

To calculate NRR accurately, it is important to consider various traits that can impact the calculation. These include Customer Acquisition Costs, Pricing Models, Upselling Strategies, and Churn Rates.

By understanding these traits and their potential impacts on Net Revenue Retention Rate calculations, SaaS businesses can gain valuable insights into their performance and make informed decisions about optimizing their operations for greater success.